The Facts About Transaction Advisory Services Uncovered

The 10-Second Trick For Transaction Advisory Services

Table of ContentsGetting My Transaction Advisory Services To WorkThe Best Guide To Transaction Advisory ServicesUnknown Facts About Transaction Advisory ServicesNot known Facts About Transaction Advisory ServicesSome Known Incorrect Statements About Transaction Advisory Services

This step ensures the service looks its best to potential customers. Getting the organization's value right is critical for a successful sale. Advisors make use of various methods, like discounted capital (DCF) analysis, comparing to similar business, and current transactions, to identify the fair market value. This aids set a reasonable price and work out successfully with future customers.Deal consultants action in to aid by getting all the required info organized, answering questions from buyers, and arranging visits to the organization's area. Deal consultants use their know-how to aid organization proprietors handle hard arrangements, meet customer expectations, and framework offers that match the proprietor's goals.

Meeting lawful rules is essential in any kind of company sale. Transaction advisory solutions work with lawful professionals to develop and evaluate contracts, contracts, and various other legal papers. This reduces threats and makes sure the sale adheres to the regulation. The function of purchase consultants expands beyond the sale. They help company owner in preparing for their next actions, whether it's retired life, beginning a brand-new venture, or handling their newfound riches.

Deal experts bring a wealth of experience and understanding, ensuring that every facet of the sale is taken care of properly. Via critical prep work, valuation, and settlement, TAS aids entrepreneur achieve the highest feasible list price. By making sure legal and regulative compliance and managing due diligence alongside other bargain employee, purchase advisors minimize possible threats and obligations.

Transaction Advisory Services Fundamentals Explained

By contrast, Large 4 TS groups: Work with (e.g., when a prospective customer is conducting due persistance, or when a bargain is closing and the purchaser requires to integrate the firm and re-value the seller's Equilibrium Sheet). Are with charges that are not connected to the deal shutting successfully. Gain charges per engagement somewhere in the, which is less than what investment banks make even on "small bargains" (yet the collection chance is likewise much higher).

, yet they'll concentrate more on bookkeeping and evaluation and less on topics like LBO modeling., and "accountant only" topics like test equilibriums and how to stroll through events utilizing debits and credit scores instead than financial statement changes.

Transaction Advisory Services Can Be Fun For Everyone

Specialists in the TS/ FDD teams may additionally interview administration about whatever above, and they'll write a detailed report with their findings at the end of the process.

The pecking order in Transaction Solutions varies a bit from the ones in investment banking and exclusive equity careers, and the general form resembles this: The entry-level role, where you do a great deal of data and monetary evaluation (2 years for a promo from below). The following degree up; similar work, however you get the more fascinating little bits (3 years for a promotion).

Specifically, it's hard to get promoted beyond the Supervisor degree because few people leave the job at that stage, and you need to start revealing proof of your capacity to produce profits to breakthrough. Allow's start with the hours and lifestyle because those are much easier to explain:. There are periodic late evenings and weekend break work, however absolutely nothing like the frenzied nature of financial investment financial.

There are cost-of-living adjustments, so anticipate reduced settlement if you're in a less costly area outside significant monetary centers. For all placements other than Partner, the base salary comprises the mass of the complete settlement; the year-end bonus offer may be a max of 30% of your base salary. Usually, the very best method to enhance your earnings is to change to a various firm and negotiate for a greater income and benefit

Transaction Advisory Services Can Be Fun For Anyone

You might enter corporate advancement, yet investment financial obtains more tough at this stage due to here the fact that you'll be over-qualified see for Analyst functions. Business finance is still a choice. At this phase, you ought to simply stay and make a run for a Partner-level function. If you intend to leave, perhaps transfer to a client and execute their assessments and due persistance in-house.

The major trouble is that because: You typically require to join an additional Large 4 group, such as audit, and job there for a few years and after that move into TS, work there for a couple of years and afterwards move right into IB. And there's still no warranty of winning this IB role since it depends upon your area, clients, and the working with market at the time.

Longer-term, there is also some danger of and since evaluating a business's historical economic details is not specifically rocket scientific research. Yes, human beings will certainly constantly require to be entailed, however with more advanced modern technology, lower headcounts can potentially support client interactions. That stated, the Transaction Services team defeats audit in terms of pay, job, and departure chances.

If you liked this short article, you may be thinking about reading.

The 45-Second Trick For Transaction Advisory Services

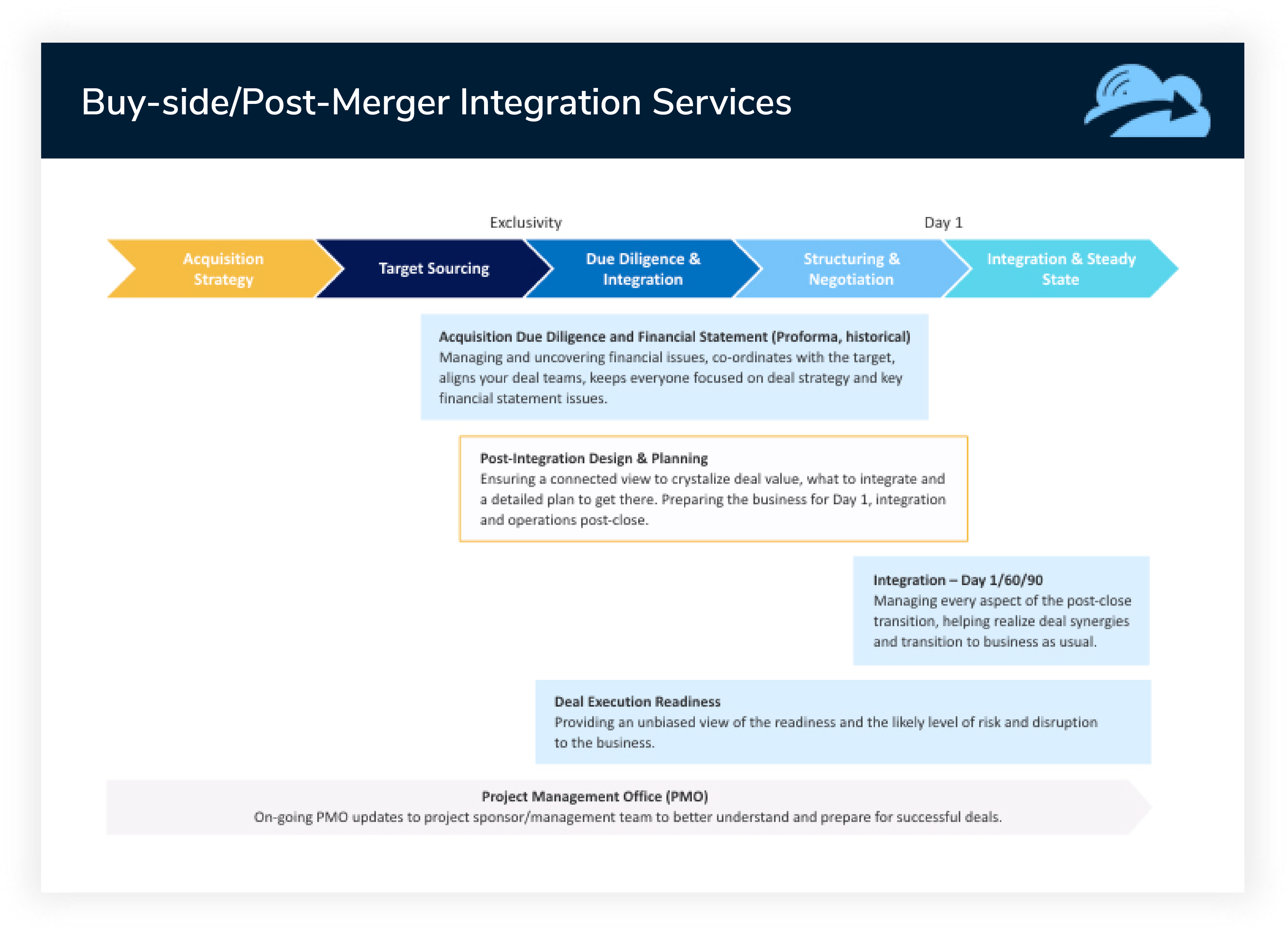

Develop advanced monetary structures that help in determining the actual market worth of a firm. Provide advising operate in relationship to company appraisal to help in negotiating and pricing frameworks. Describe one of the most appropriate form of the offer and the sort of factor to consider to utilize (cash, supply, gain out, and others).

Develop action strategies for risk and exposure that have been determined. Execute assimilation planning to determine the procedure, system, and organizational modifications that might be called for after the bargain. Make numerical estimates of assimilation prices and advantages to assess the financial reasoning of combination. Establish standards for integrating departments, innovations, and company processes.

Assess the possible consumer base, market verticals, and sales cycle. The operational due diligence supplies essential understandings right into the performance of the company to be obtained worrying threat analysis and worth development.